Intel (INTC) had been an unrewarding investment for at least ten years, ending last summer �� during which, the stock had trailed many benchmarks including the S&P 500 (SPY).

However, in the past year, its shares have picked up strong momentum, delighting investors who have become passionate about the future of Data Centers and Non-Volatile Memory - two fields that are in investors' recent vogue.

In the past, I had felt Intel lacked the ambition to deliver strong growth, that Intel was being weighed down by its PC-centered business. However, in spite of its shares rallying close to 50% in the past 12 months, I now actually think that patient investors might still be rewarded with 40-50% upside over the next two years. If you have not read my articles before, I would like to inform you, that is a rare re-appraisal on my part.

Recent DevelopmentsExcluding its McAfee divestment, Intel posted 13% organic growth. For a company of its size, 13% organic growth is quite substantial growth. Previously, my gripe with Intel had been its persistent determination to hold onto its legacy and declining revenue from its PC-centric ('CCG') businesses. Because, in spite of management's attempt to distract investors, this legacy business had for a long time been generating close to 60% of its overall revenue - thus the bulk of Intel��s revenue.

However, as of its most recent quarter (Q1 2018), Intel now generates only 51% of its revenue from its CCG segment - with the rest of Intel��s consolidated revenue being generated from its data-centric business, which is now growing at solid double-digits.

The New StoryInvestors of late have become infatuated with the opportunity that the cloud may provide for many chip makers, such as Intel - and for good reasons. As proven by Intel's Data Center Group (DCG), which generated nearly a third of Intel's Q1 consolidated revenue; there is strong demand in this sector. However, more pertinent to Intel, Intel's significant scale allowed Intel to post fantastic margins from its data-center group, which saw its operating margins go from 35% in Q1 2017 to 50% in Q1 2018.

Strong double-digits revenue growth in all of its data-centric operations, combined with its drive to bring down its total spend to 30% ahead of schedule by a full two years (as of Q1 2018 this was still at 32.4%), offers Intel strong operational leverage and allowed management to feel confident of its operations and to raise its full-year guidance. With its top-line revenue guidance being raised by roughly 3.8%, while more important for value investors, free cash flow guidance was also raised by more than 10% to $14.5 billion.

ValuationRisk-averse investors could be concerned that Intel's debt of $28.6 billion is quite substantial, amounting to close to 41% of its stockholders' equity. However, Intel also carries a significant amount of cash and equivalents amounting to roughly $16 billion, making its overall position a net debt position of roughly $12.6 billion. Thus, for a company which is able to bring in close to $14.5 billion in free cash flow in a single year, one could argue that Intel is actually underutilizing its financial position, leaving Intel plenty of room to either do some plug-in M&A or meaningfully increase its share repurchase plan.

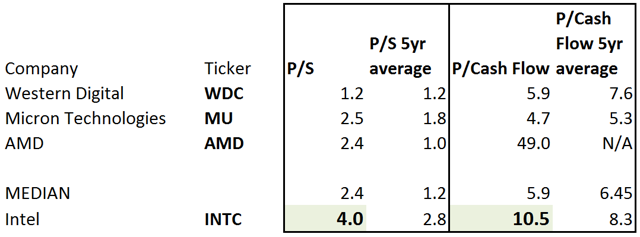

Source: author's calculations, morningstar.com

I'm a big fan of the P/S ratio, as I feel that this ratio is remarkably good at cutting through the noise. Generally speaking, a company's revenue is significantly less volatile from year-to-year, than EPS or free cash flow. And as we can see in the above table, how investors over the past 5 years have only been willing to pay 2.8X on a P/S ratio for Intel's opportunity, but how presently investors are nearly willing to pay 50% more than they have historically.

Having said that, I do not think this re-pricing is totally unwarranted. As I presently believe that Intel has demonstrated that its drive to grow its business away from being PC-centric, combined with the company bringing down its total spend ahead of schedule, is not being sufficiently rewarded in its present share price. Incidentally, for those that have followed me in the past, this is in direct opposition to what I had previously opined about Intel.

TakeawayIntel had strong Q1 2018 numbers and raised its full-year guidance. Although its shares have noticeably rallied of late and started to close its margin of safety, overall I do not feel that Intel is fully priced at $250 billion market cap, and expect it to revalue to around $350 billion market cap over the next two years.

Disclaimer: Please do your own due diligence to reach your own conclusions.

Note: The only favor I ask is that you click the "Follow" button so I can grow my Seeking Alpha friendships and our Deep Value network. Please excuse any grammatical errors.

At Deep Value Returns, I��m laser-focused on two things: free cash flow and unloved businesses. Companies that are going through troubled times, but that are otherwise stable and cash flow generative can be bought on the cheap, providing investors with an opportunity for exceptional returns once those names come back in favor - as they often do. If you��re looking for a deep value investing approach inspired by Buffett, Icahn, and Greenblatt that can help you generate between 50% and 200% potential upside in just a few years, then sign up for your two-week free trial with Deep Value Returns today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment